On Saturday November 6th, 2021, Tesla CEO Elon Musk released a Twitter poll asking if he should sell 10% of his Tesla holdings. Out of 3.5 million ...

As 2021 draws to a close, now is a good time to consider smart money moves. “It’s a marathon, not a sprint” may be an overused phrase, but be...

Inflation: What is it and why are we freaked out by it? Inflation is a decline in the purchasing power of a given currency, and is measured by the...

Imagine two builders, both tasked with building identical, structurally sound, and physically comfortable homes in the same general location. The o...

Politics and religion – two topics to be avoided at work, social gatherings, and if you are looking to stay away from unwinnable discussions with s...

Imagine going to the supermarket with a simple goal: purchase food for the week. Easy enough, but of course there are the food allergies, the 6-yea...

A 2018 BBC article noted that “there are an estimated 171,146 words currently in use in the English language.” We have a lot of words and the finan...

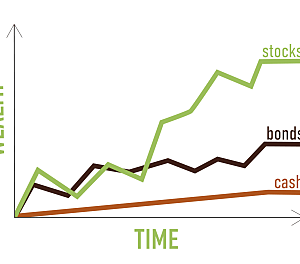

Classically defined, investing is “the outlay of money, usually for income or profit.” In personal finance, investing can be found at the crossroad...

The role of debt in our lives is an important concept in personal finance. I previously described the principle to “spend less than you make.” Ther...

A recent survey from Bankrate.com found that only 39% of Americans have enough cash saved to cover an unexpected $1,000 expense. While the past yea...

The importance of “financial wellness” has increased in popularity in recent years. According to the University of San Diego, “Financial wellness i...